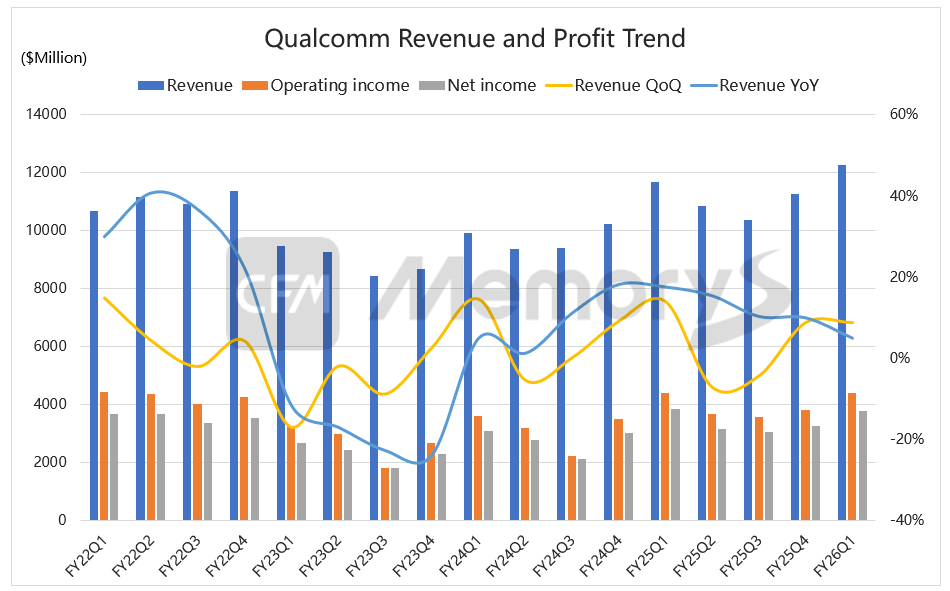

Qualcomm announced its financial results for the first quarter of fiscal year 2026 (ended December 28, 2025). The company reported revenues of $12.25 billion, with a year-on-year increase of 5%. Non-GAAP net income was $3.78 billion, with a year-on-year decrease of 1%. Non-GAAP diluted earnings per share is $3.50.

Source: Qualcomm; Made by CFM

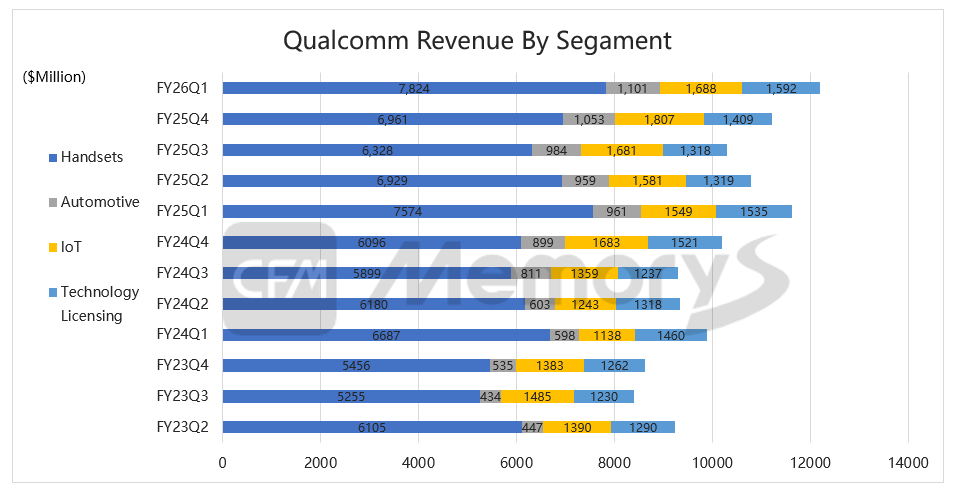

By business segment, revenues of QCT grew by 5% year-on-year to $10.61 billion, while revenues of QTL increased by 4% year-on-year to $1.59 billion.

Within the QCT segment, revenues of handsets increased 3% to $7.82 billion, revenues of automotive rose 15% to $1.1 billion, and revenues of IoT grew 9% to $1.69 billion.

Source: Qualcomm; Made by CFM

During the earnings conference call, Qualcomm CEO Cristiano Amon stated that despite strong end-market demand, the mobile phone industry is facing severe memory shortages. Smartphone supply chains may encounter issues, leading to lower-than-expected production for some customers. While it remains unclear whether smartphone manufacturers will raise prices, it is anticipated that Qualcomm's clients will shift their focus toward high-end smartphones. Compared to entry-level smartphones, high-end models are better positioned to absorb the cost pressures arising from memory price increases. Qualcomm's competitiveness in the high-end smartphone market is particularly prominent. Therefore despite facing supply headwinds, its position in high-end market remains solid.

In PC and robotics sectors, Qualcomm continues to advance the ecosystem for Windows on ARM. It is projected that 150 commercial PCs equipped with Snapdragon X series will be launched this year. Additionally, Qualcomm officially announced its expansion into the advanced robotics field this quarter, introducing Dragonwing IQ10 series of chips designed to accelerate the commercialization of household, industrial, and humanoid robots. Qualcomm has already initiated collaborations with leading robotics companies such as Figure and KUKA.

In the data center business, Qualcomm is implementing a dual-track strategy: one based on the Oryon CPU and the other on a RISC-V architecture CPU, strengthened through the acquisition of Ventana Microsystems. The data center business is expected to begin generating substantial revenue in 2027.

While demand in the high-end smartphone market remains robust and Qualcomm is driving its corporate transformation by increasing chip sales in areas such as automotive, PCs, and data centers, the scale of these new businesses still cannot be sufficient to offset the impact of the slowdown in the handsets chip market yet. For the second quarter of fiscal year 2026 (January–March 2026), Qualcomm expects its revenues to range between $10.2 billion and $11 billion, with Non-GAAP diluted earnings per share projected to be in the range of $2.45 to $2.65. Both figures fall short of the average market estimates.