The widespread adoption of AI-agent has significantly increased AI inference workloads, driving not only a surge in global demand for AI servers but also a substantial rise in demand for traditional servers. In the fourth quarter, led by AI-driven demand, willingness of hyperscale cloud service providers to procure servers continued to intensify, directly fueling a sharp increase in memory chip orders. However, supply growth lagged considerably behind demand, widening the server memory supply gap and even constraining server shipments. Meanwhile, as capacity was prioritized to fulfill server market shipments, supply constraints in the Mobile and PC markets have been further deepened. To avoid production disruptions caused by memory shortages, customers actively moved to lock in capacity resources. Driven by the above factors, DRAM and NAND Flash prices saw significant increases in the fourth quarter, with the supply-demand imbalance continuing to spread. Memory prices are expected to maintain an upward trend throughout 2026.

According to CFM analysis, the global DRAM/NAND Flash market reached $75.51 billion in the fourth quarter of 2025, up 29.2% quarter-over-quarter. The global DRAM market grew 29.8% quarter-over-quarter to $51.97 billion, while the NAND market increased 27.8% quarter-over-quarter to $23.55 billion. For the full year, the global DRAM/NAND Flash market surpassed $200 billion for the first time in history, reaching $221.59 billion, a year-over-year increase of 32.7%.

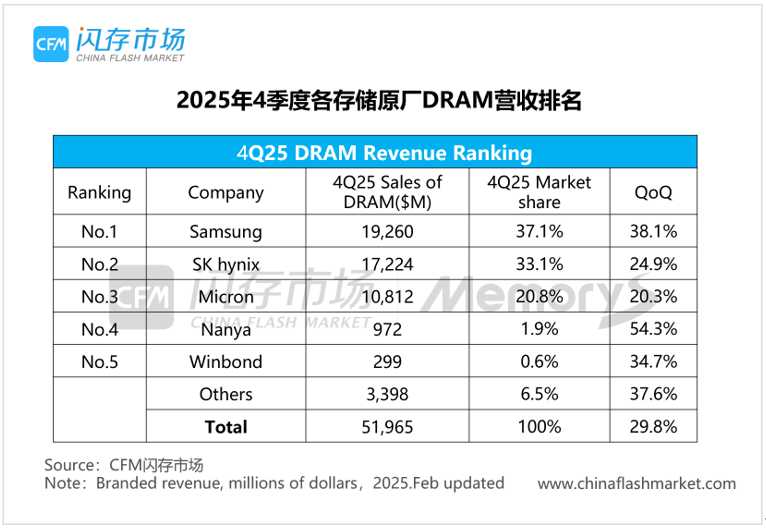

Global DRAM Market Size Reaches $51.97 Billion in 4Q25, Up 29.8% QoQ

Demand for high-density DDR5, LPDDR5X, and HBM used in servers remained robust, while a significant supply gap persisted in the DRAM market during the fourth quarter. Although DRAM bit shipments saw limited growth, a sharp increase in DRAM ASP drove the DRAM market size up 29.8% quarter-over-quarter.

By vendor,

Samsung recorded $19.26 billion in DRAM sales in Q4, up 38.1% sequentially, capturing a 37.1% market share to rank first;

SK Hynix posted $17.22 billion in DRAM sales, up 24.9% quarter-over-quarter, with a 33.1% share to rank second;

Micron's DRAM sales reached $10.81 billion in Q4 (September–November 2025), up 20.3% sequentially, accounting for a 20.8% market share and ranking third;

Nanya Technology reported $972 million in Q4 DRAM sales, up 54.3% quarter-over-quarter, representing a 1.9% share;

Winbond recorded $299 million in Q4 DRAM sales, up 34.7% sequentially, with a 0.6% market share.

Global NAND Market Size Reaches $23.55 Billion in 4Q25, Up 27.8% QoQ

Demand for SSDs optimized for AI inference workloads grew rapidly, while tightening supply conditions for NL HDDs drove rising substitution demand for QLC SSDs. Major memory manufacturers continued to expand Server SSD supply to meet growing needs, driving the global NAND market up 27.8% quarter-over-quarter to $23.55 billion in Q4.

By vendor,

Samsung recorded $6.35 billion in Q4 NAND Flash sales, up 18.4% sequentially, capturing a 27.0% market share to rank first;

SK Hynix posted $5.21 billion in Q4 NAND Flash sales, up 47.4% quarter-over-quarter, with a 22.1% share to rank second;

Kioxia reported $3.52 billion in Q4 NAND Flash sales, up 15.7% sequentially, holding a 15.0% market share to rank third;

WD recorded $3.03 billion in Q4 NAND Flash sales, up 31.1% quarter-over-quarter, accounting for a 12.8% share to rank fourth;

Micron posted $2.74 billion in NAND Flash sales for Q4 (September–November 2025), up 21.8% sequentially, representing an 11.6% market share and ranking fifth.