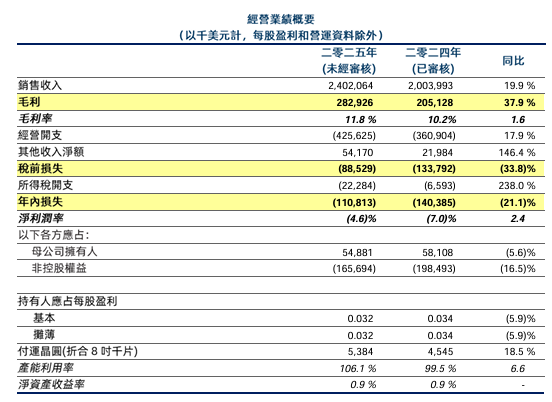

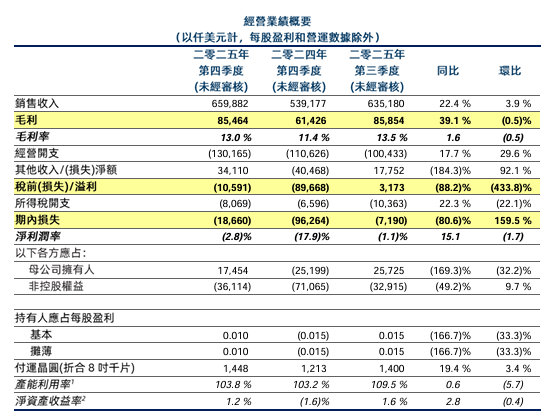

Hua Hong Semiconductor (01347.HK; 688347.SH) today announced its fourth quarter and full-year 2025 results. Fourth-quarter revenue reached US$659.9 million, a year-on-year increase of 22.4% and a quarter-on-quarter increase of 3.9%, setting a new record high; gross margin was 13.0%, an increase of 1.6 percentage points year-on-year; full-year revenue was US$2.4021 billion, a year-on-year increase of 19.9%; gross margin was 11.8%, an increase of 1.6 percentage points year-on-year; the company's average capacity utilization rate for the year reached 106.1%, a leading level among wafer foundries, reflecting strong market demand and the company's strong operational efficiency.

Source: Public information

In the fourth quarter, 12-inch wafer sales revenue reached US$407 million, a year-on-year increase of 41.9%, accounting for 61.7% of total revenue. In terms of technology platforms, embedded non-volatile memory (eNVM) revenue reached $180 million, a year-on-year increase of 31.3%, primarily driven by increased demand for MCUs and smart card chips; analog and power management (PMIC) revenue reached $174 million, a year-on-year increase of 40.7%, leading the growth rate among all platforms; standalone non-volatile memory (Standalone NVM) revenue reached $56.6 million, a year-on-year increase of 22.9%, driven by continued strong demand for flash memory products. Dr. Bai Peng, Chairman and President of the company, stated that the standalone flash memory and power management platforms performed particularly well, strongly supporting revenue growth and profit margin increases.

Source: Public information

Capital expenditures this quarter totaled $633.5 million, of which $559 million was invested in Huahong's 12-inch production line. The first phase of capacity construction for the second 12-inch production line in Wuxi (FAB9) was completed ahead of expectations, and the acquisition of the Shanghai 12-inch manufacturing base (FAB5) is progressing smoothly, laying a solid foundation for the company's medium- and long-term growth.

Looking ahead to the first quarter of 2026, the company expects sales revenue of approximately US$650 million to US$660 million, with a gross margin of approximately 13% to 15%. Dr. Bai Peng stated that the company will continue to focus on its world-class specialty process technology platform, deepen cooperation with strategic customers at home and abroad, and seize growth opportunities amidst the changing landscape of the global semiconductor industry.